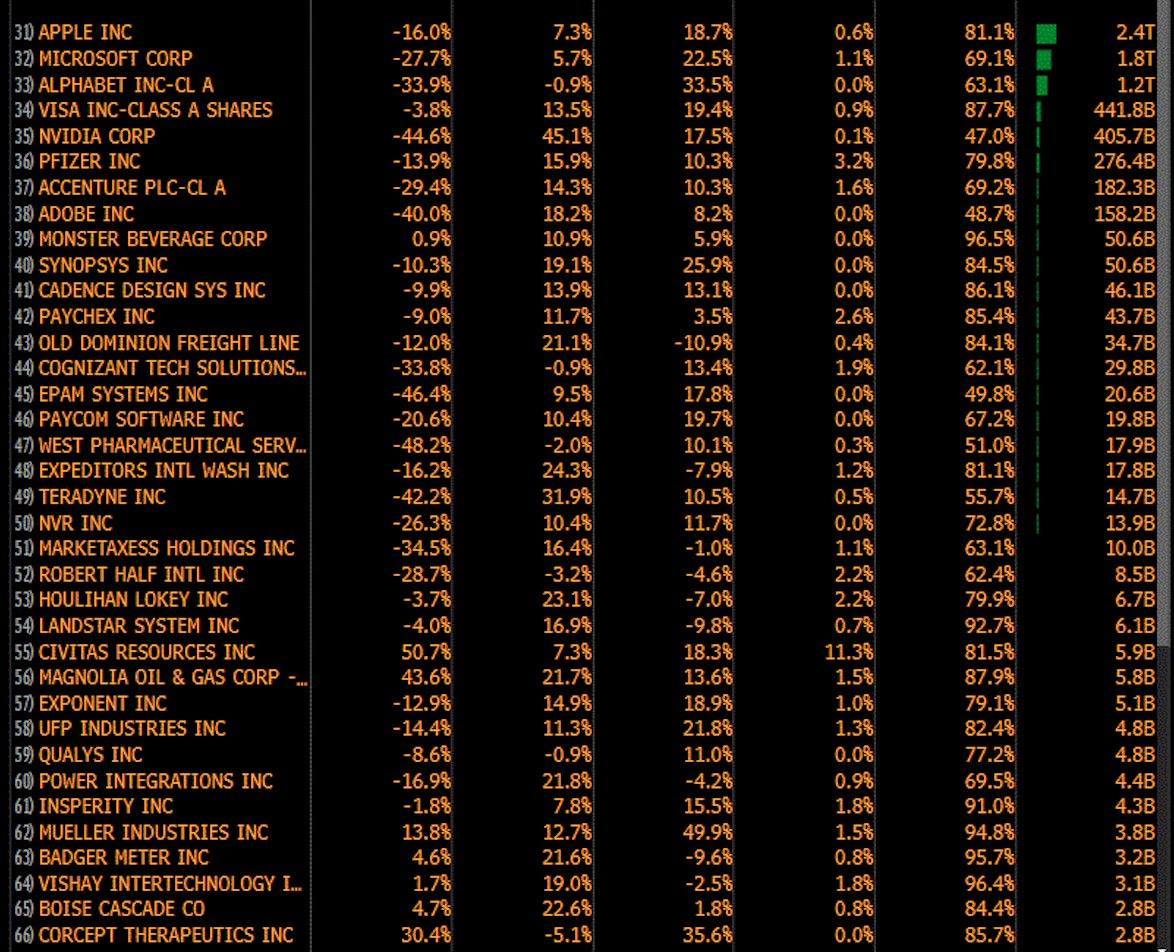

Looking for investment inspiration?

Here are a few great criteria to screen for quality companies:

In this article we share 15 Quality stocks which match these criteria.

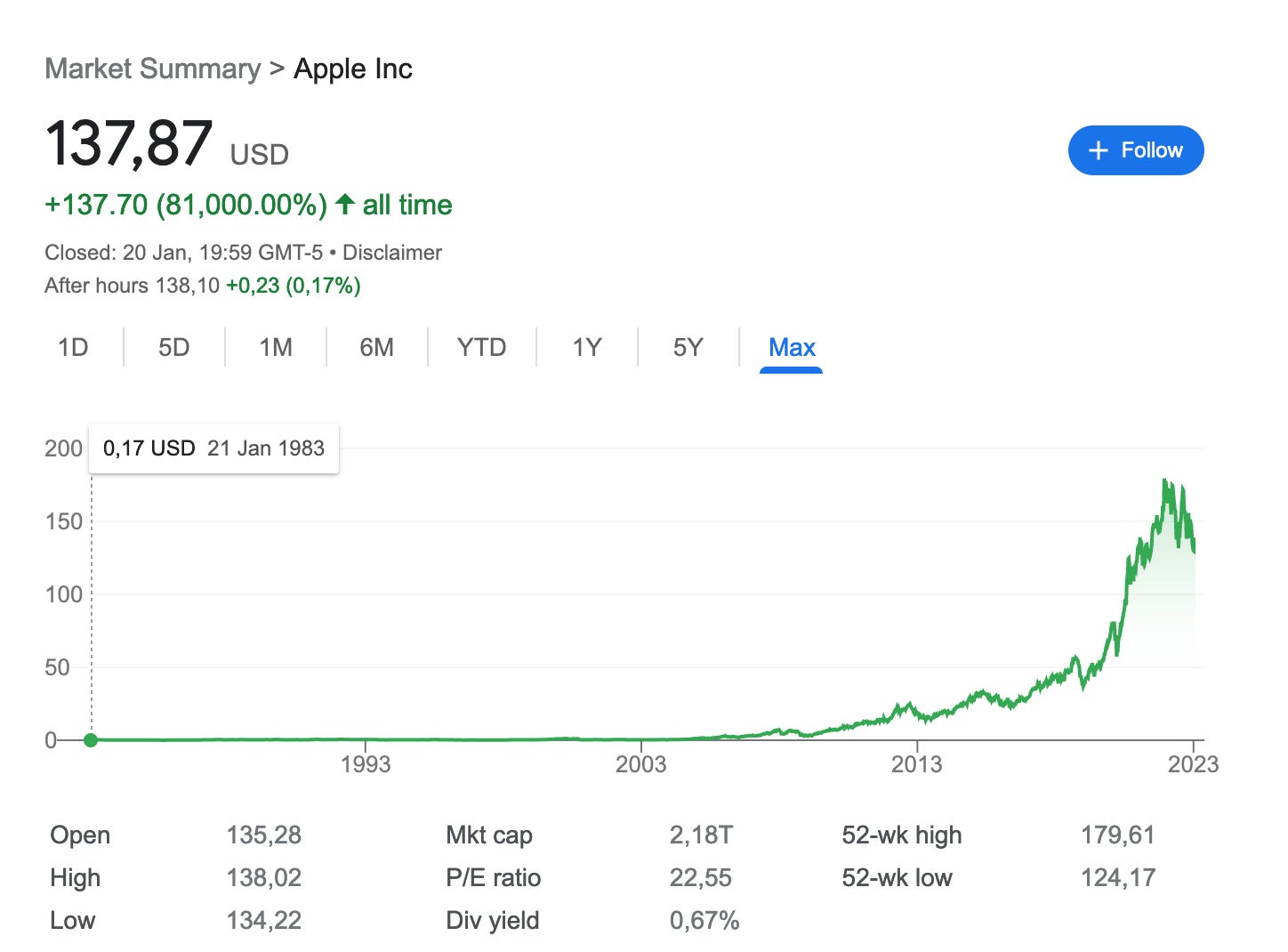

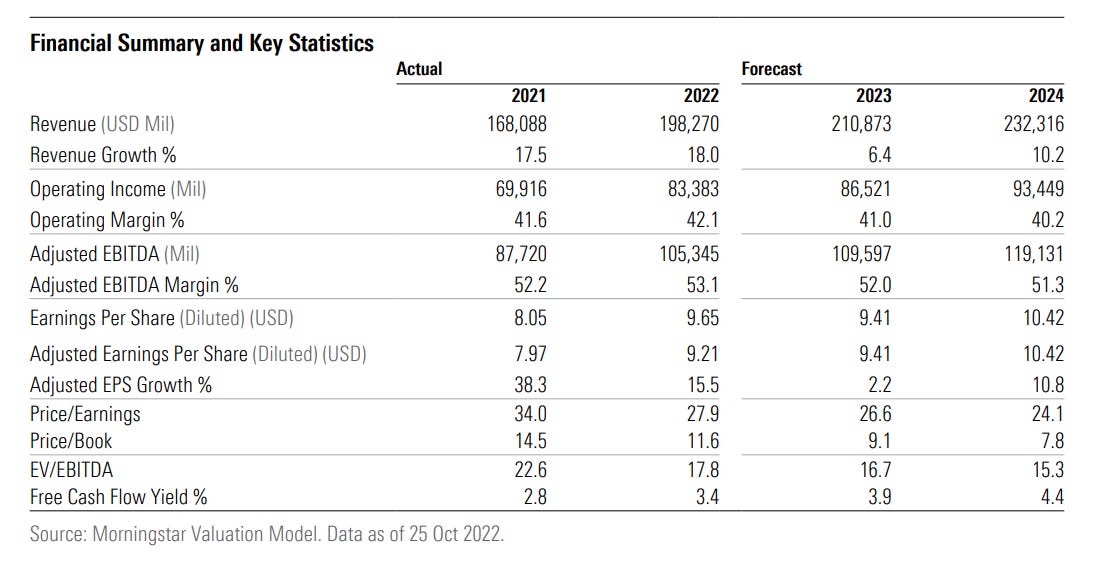

Company 1: Apple ($AAPL)

Apple is the largest company in the world which manufactures, and markets smartphones, personal computers and tablets. 18% of all new phones sold are iPhones.

FCF Margin: 28.3%

ROIC: 48.8%

FCF Yield: 5.2%

Expected yearly FCF Growth (next 3 years): 5.7%

CAGR since IPO: 19.5%

Company 2: Microsoft ($MSFT)

Microsoft operates as a software company. Word, Excel, … are all applications of Microsoft. Microsoft is also active in cloud storage.

FCF Margin: 32.3%

ROIC: 28.1%

FCF Yield: 3.8%

Expected yearly FCF Growth (next 3 years): 12.3%

CAGR since IPO: 22.7%

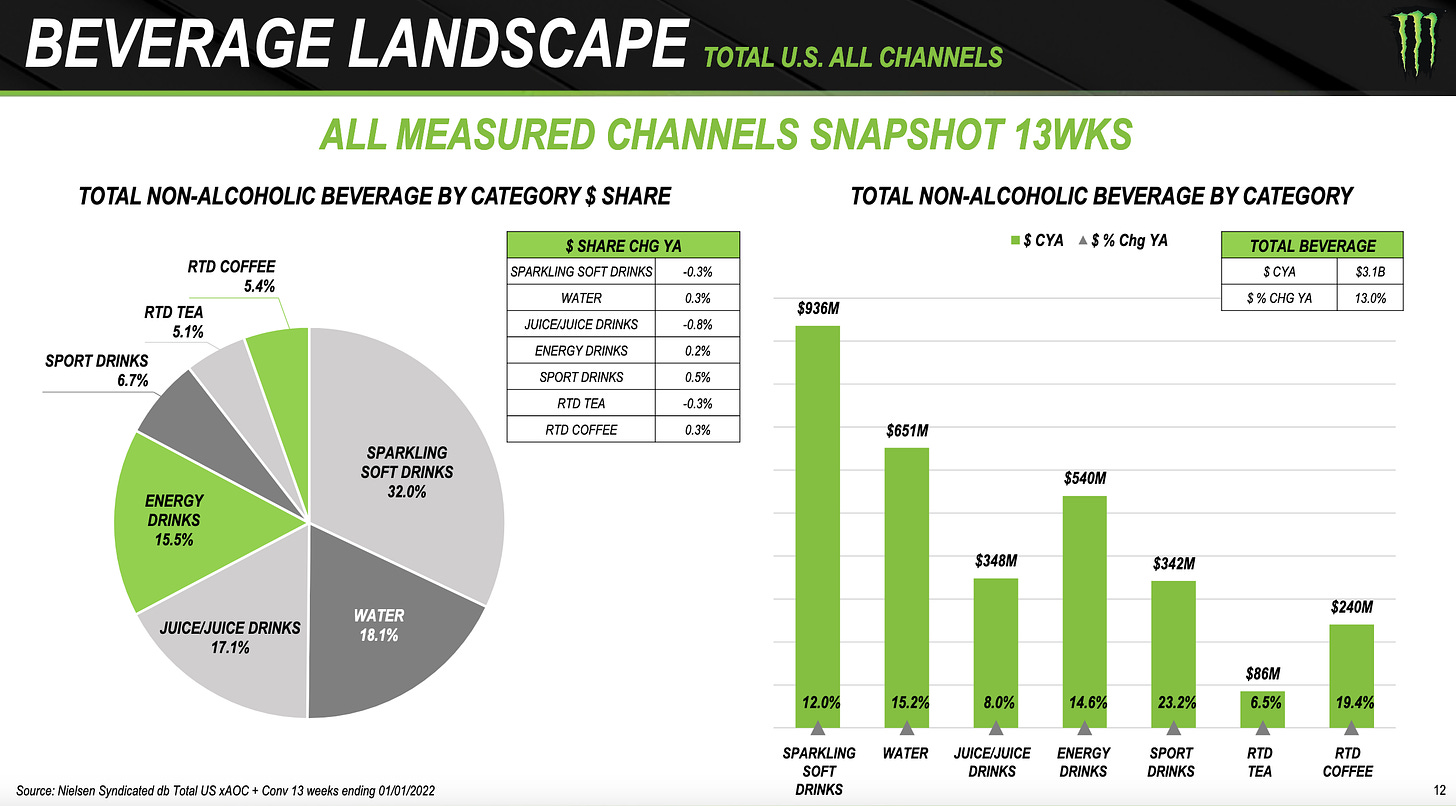

Company 3: Monster Beverage ($MNST)

Monster Beverage markets and distributes energy drinks. Monster Beverage is the best performing stock within the S&P 500 since 2000.

FCF margin: 20.1%

ROIC: 18.5%

FCF yield: 2.0%

Expected FCF growth (next 3 years): 16.3%

CAGR since IPO: 19.3%

Company 4: Alphabet ($GOOGL)

Everyone knows Google. The company has a (quasi-)monopoly in digital advertisements. Charlie Munger once stated that Alphabet has one of the widest moats he has ever seen.

FCF Margin: 26.0%

ROIC: 23.9%

FCF Yield: 5.3%

Expected yearly FCF Growth (next 3 years): 10.2%

CAGR since IPO: 22.7%

Company 5: Visa ($V)

Together with Mastercard, Visa dominates the market for digital payments. Electronic payments are in a strong secular trend, giving a tailwind to Visa.

FCF margin: 61.0%

ROIC: 24.5%

FCF yield: 3.9%

Expected FCF growth (next 3 years): 18.2%

CAGR since IPO: 22.8%

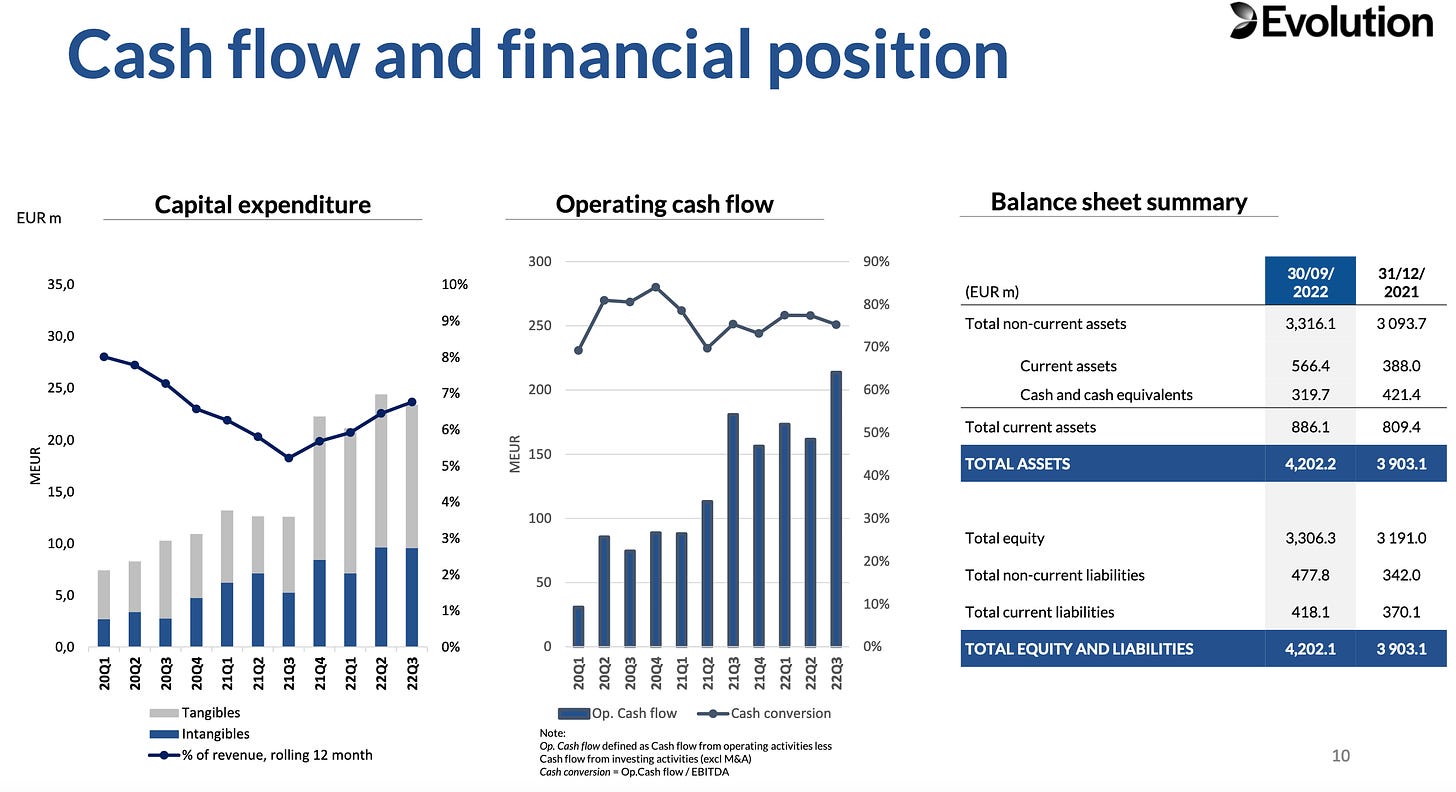

Company 6: Evolution AB ($EVO)

Evolution AB operates as a gaming company. The Company develops, produces, markets and licenses fully integrated B2B live casino solutions to online casino operators.

FCF Margin: 52.9%

ROIC: 21.5%

FCF Yield: 5.1%

Expected yearly FCF Growth (next 3 years): 14.6%

CAGR since IPO: 72.3%

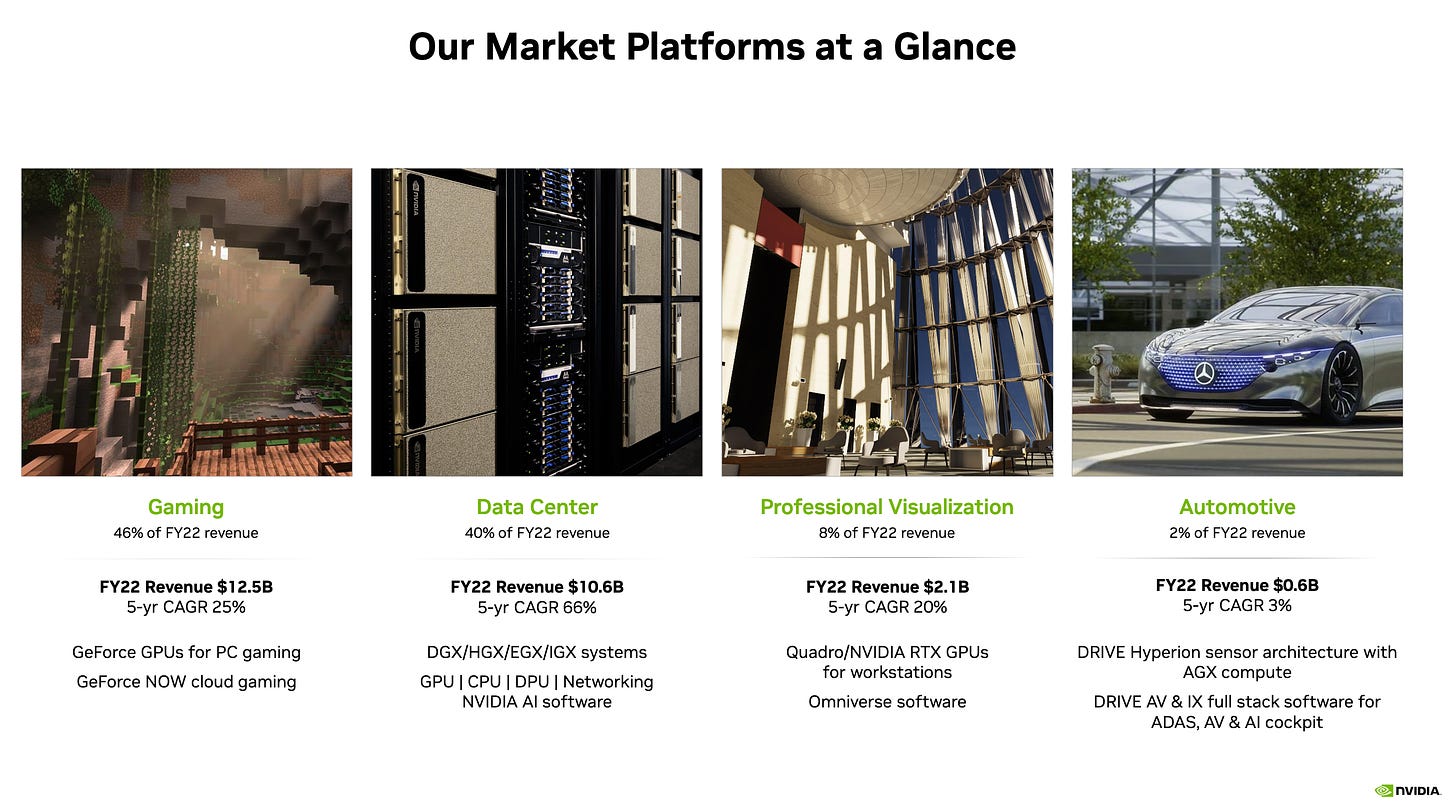

Company 7: Nvidia ($NVDA)

Nvidia is known for developing integrated circuits, which are used in everything from electronic game consoles to personal computers (PCs). The company is a leading manufacturer of high-end graphics processing units (GPUs).

FCF margin: 30.2%

ROIC: 18.7%

FCF yield: 2.2%

Expected FCF growth (next 3 years): 25.2%

CAGR since IPO: 31.6%

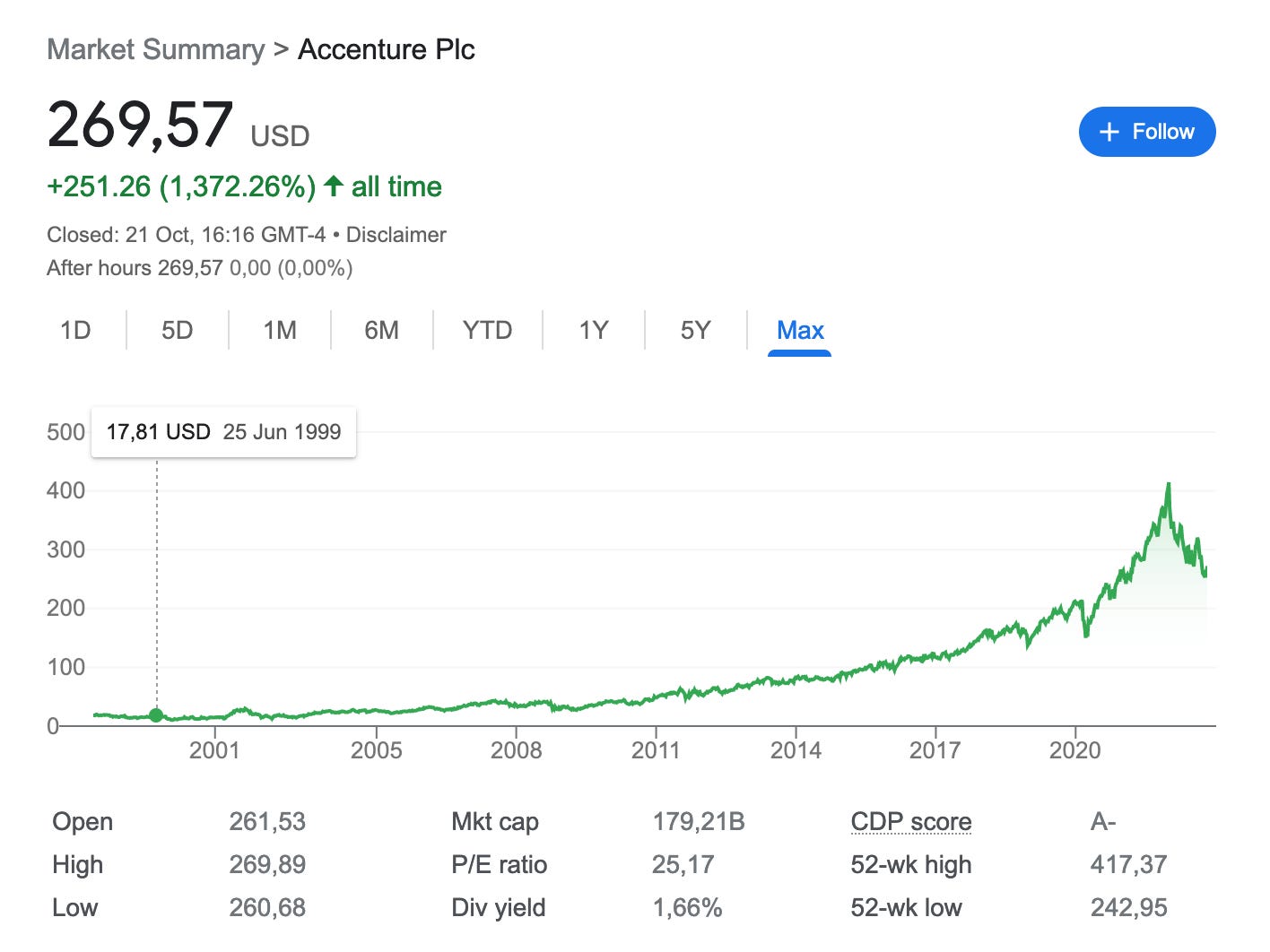

Company 8: Accenture ($ACN)

Accenture is a consultancy company with management and technology consulting services and solutions.

FCF Margin: 14.3%

ROCE: 32.1%

FCF Yield: 4.9%

Expected yearly FCF Growth (3 yr): 7.6%

CAGR since IPO: 16.4%

Company 9: Old Dominion Freight Line ($ODFL)

Old Dominion Freight Line is the fourth-largest less-than-truckload carrier in the United States. The company is by far one of the most disciplined and efficient providers in the trucking industry.

FCF margin: 12.6%

ROIC: 36.8%

FCF yield: 2.7%

Expected FCF growth (next 3 years): 2.8%

CAGR since IPO: 19.8%

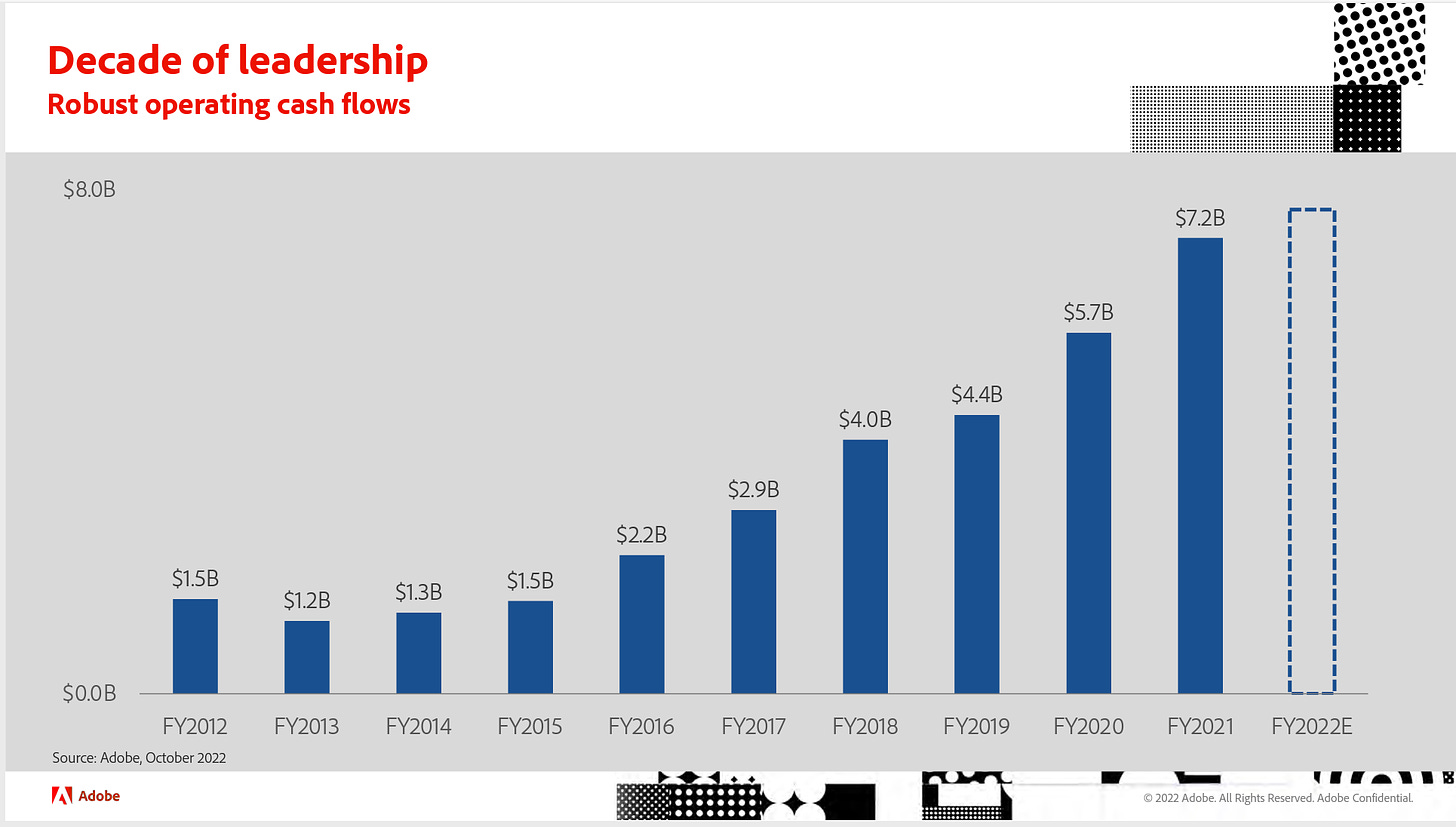

Company 10: Adobe ($ADBE)

Adobe is a true compounding machine active in computer software products and technologies. Adobe’s products allow users to express and use information across all print and electronic media.

FCF margin: 42.1%

ROIC: 26.4%

FCF yield: 4.6%

Expected FCF growth (next 3 years): 24.3%

CAGR since IPO: 17.6%

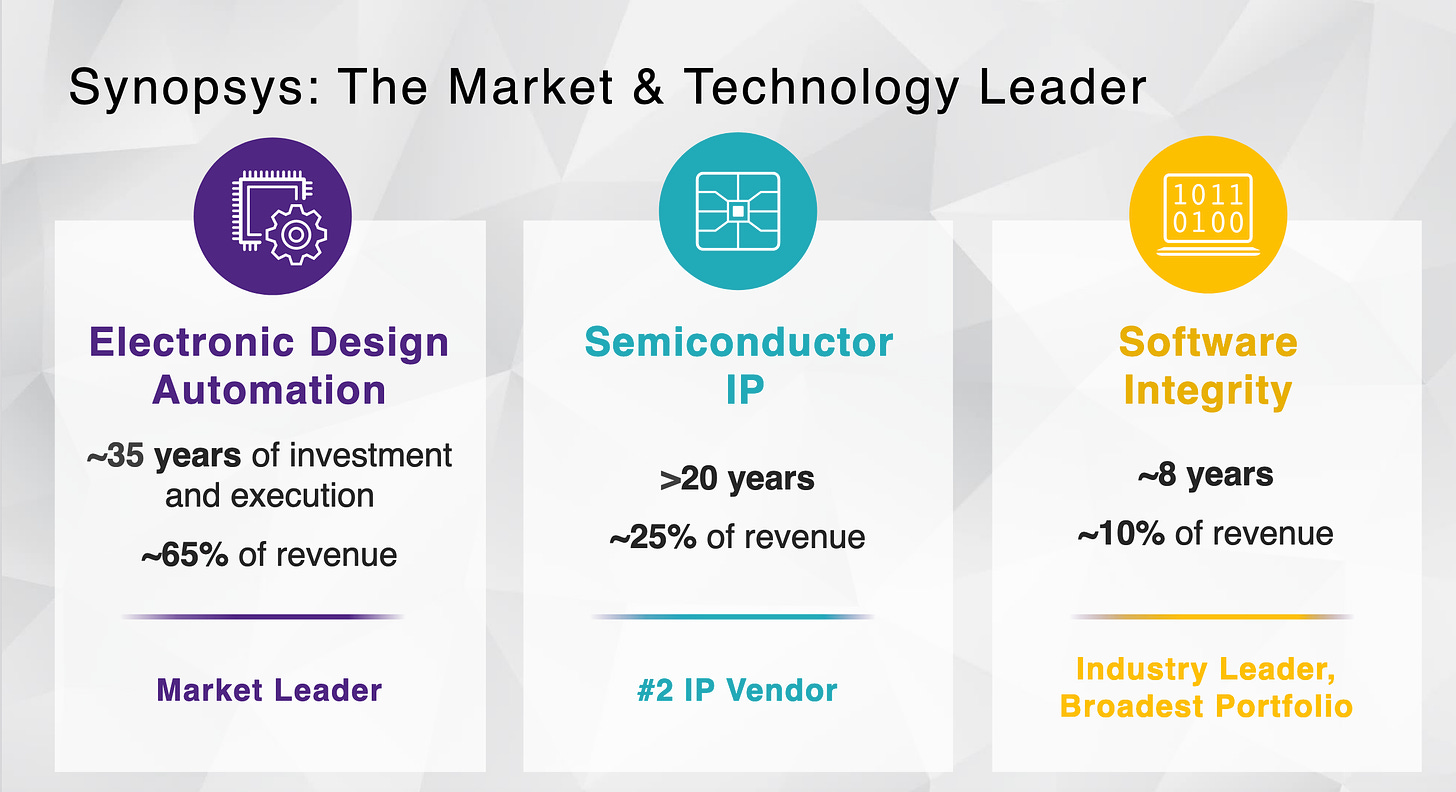

Company 11: Synopsys ($SNPS)

Synopsys is a provider of electronic design automation software, intellectual property, and software integrity products. EDA software automates the chip design process, enhancing design accuracy, productivity, and complexity in a full-flow end-to-end solution.

FCF margin: 31.5%

ROIC: 16.7%

FCF yield: 2.9%

Expected FCF growth (next 3 years): 24.0%

CAGR since IPO: 12.8%

Company 12: InMode ($INMD)

InMode develops medical devices, manufacturing platforms that harness novel radio-frequency based technology.

FCF Margin: 48.7%

ROIC: 39.3%

FCF yield: 7.2%

Expected FCF Growth next 3 years: 7.2%

CAGR since IPO: 64.3%

Company 13: O’Reilly Automotive ($ORLY)

O’Reilly Automotive is one of the largest sellers of aftermarket automotive parts, tools, and accessories, serving professional and DIY customers. The company sells branded as well as own-label products

FCF Margin: 20.7%

ROIC: 40.3%

FCF yield: 3.6%

Expected FCF Growth next 3 years: 7.6%

CAGR since IPO: 21.6%

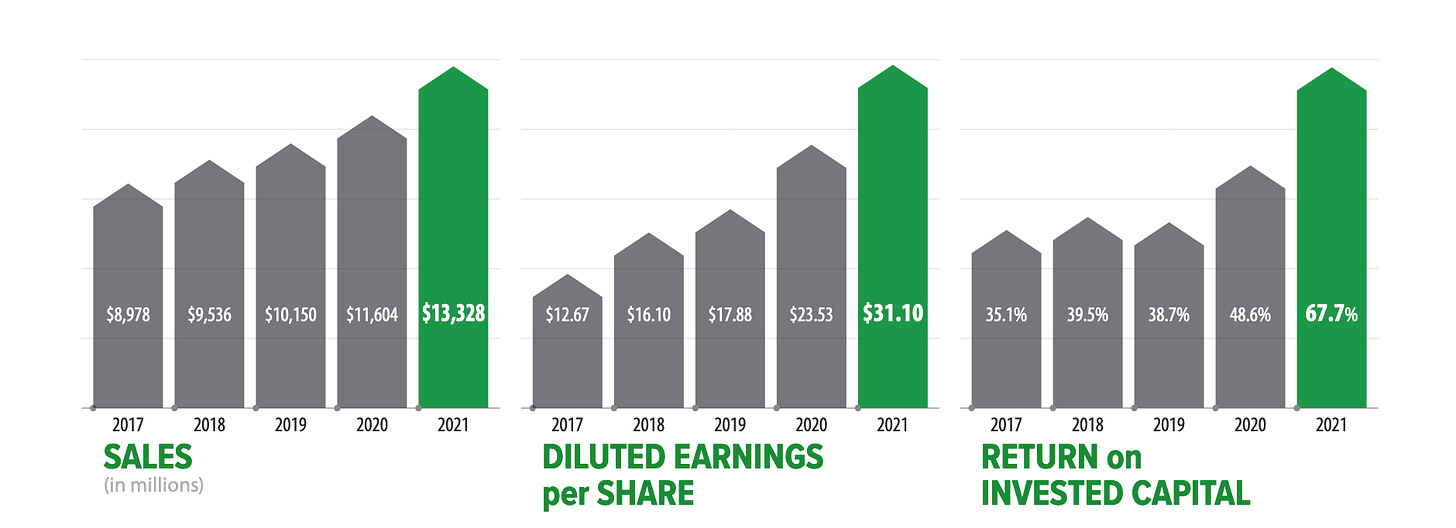

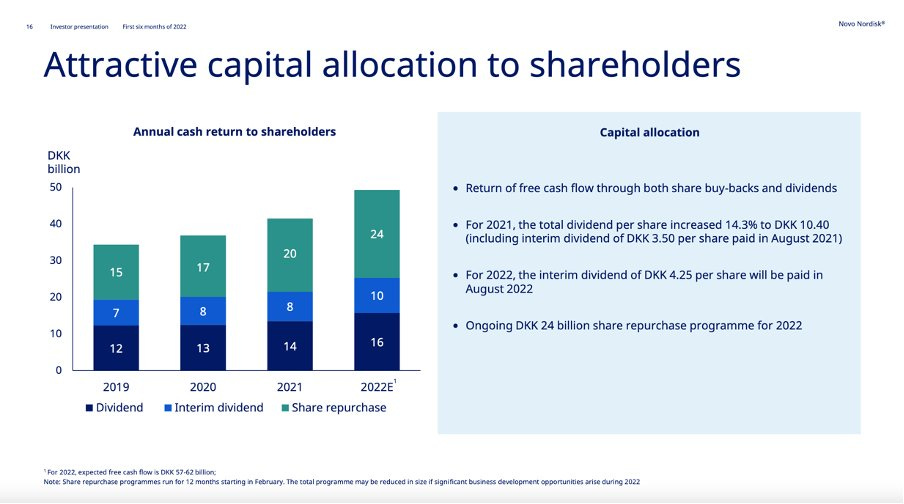

Company 14: Novo Nordisk ($NOVO-B)

Novo Nordisk is active in diabetes treatment. More and more people will suffer from diabetes due to our aging population and obesity.

FCF Margin: 34.6%

ROIC: 62.0%

FCF yield: 2.7%

Expected FCF Growth next 3 years: 14.4%

CAGR since IPO: 19.9%

Company 15: Mastercard ($MA)

Just like Visa, Mastercard is a beautiful company. Mastercard has a huge competitive advantage, high profit margins and a healthy balance sheet.

FCF margin: 48.0%

ROIC: 49.3%

FCF yield: 2.7%

Expected FCF growth (next 3 years): 12.8%

CAGR since IPO: 31.0%

Still looking for more?

Still looking for more?

Here are a few other examples of Compounding Quality stocks:

What should we write about next?

What should we write about next? Let us know here:

Contact details

Do you want to read more from us? Please subscribe to our Substack where we provide investors with investment insights on a weekly basis.

If you have any suggestions to further improve our posts, or do you want certain topics to be covered? Send us an email:

About the author

Compounding Quality is a professional investor which manages a worldwide equity fund with more than $150 million in Assets Under Management. We have read over 500 investment books and spend more than 50 hours per week researching stocks.

If you liked this article, feel free to support us by giving this article a like. Sharing our content is also highly appreciated. We are writing everything completely for free and don’t want to add adds to our articles.

In our opinion, one of these companies stands out as different-Old Dominion Freight Line. Its crazy and fascinating that a trucking company makes the top 10 on the list. Speaks to the company's management over the years.

I don't know if this is possible, but it would be very interesting to me to see what the performance of the S&P 500 index would be if you removed the highest quality names. I would bet that even over the long term it would be quite unimpressive.